E-Mudra loan facility of State Bank of India was started for such people who are unable to start their own start-up or business due to lack of money. This facility will also benefit the students and women will also be able to get help due to this loan. This loan will be given by the government and will be able to take it only from government banks, in which banks like SBI are the main ones.

Who can take SBI E-Mudra Loan? – Eligibility

To avail an E-Mudra loan, the following standards must be met by the person applying for the loan: –

- The age of the person should be 18 years to 65 years

- The person is a resident of India.

- Must have an account with State Bank

- Lived up to the bank’s standards.

- Must have Aadhaar link with bank and mobile number must be linked with Aadhaar

How much loan will be available under SBI E-Mudra loan scheme?

Under this scheme, loans ranging from one thousand to twenty five thousand will be available.

SBI E-Mudra Loan Official Notification – SBI-eMUDRA PDF

BI E-Mudra loan Apply Online, Registration 2023-25

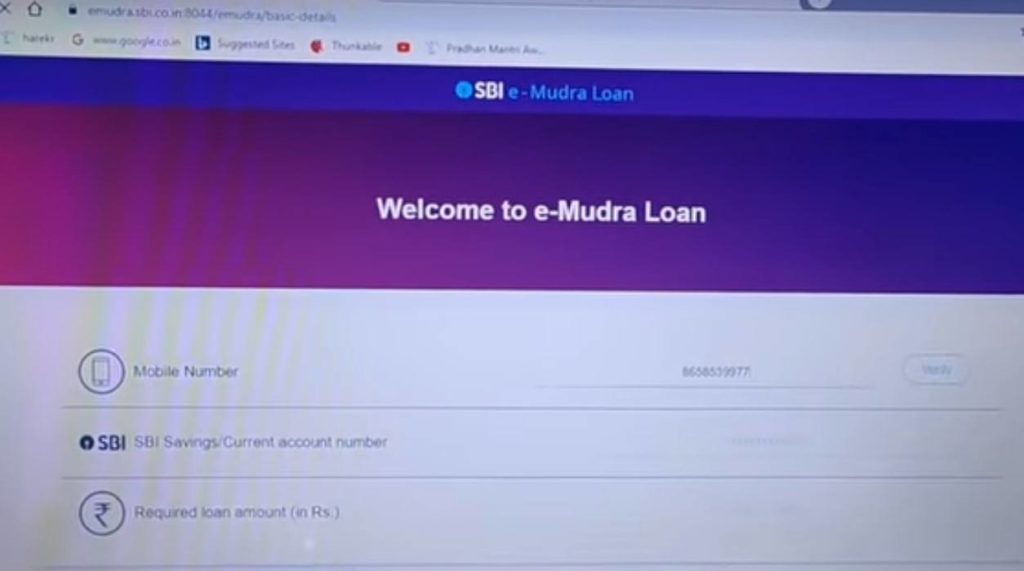

- First of all visit the Mudra loan website http://emudra.sbi.co.in/.

- As soon as the official website opens, you will be asked for the mobile number first.

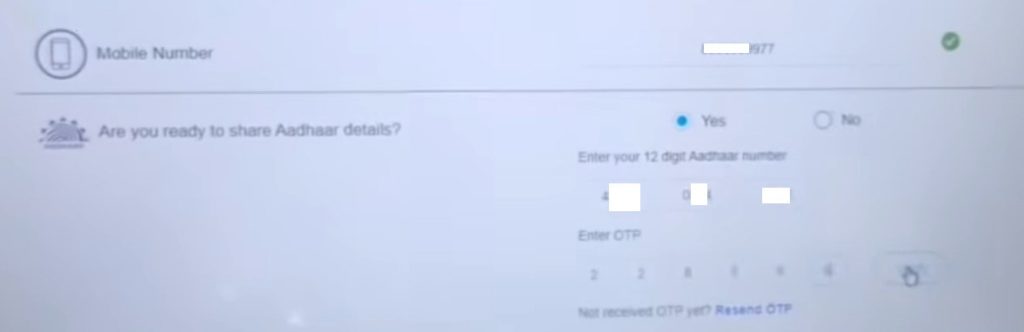

- After entering the mobile number, you enter your Aadhaar number and click on Gate OTP. Now OTP will come on the mobile number linked from your Aadhaar, which you have to fill in the given space.

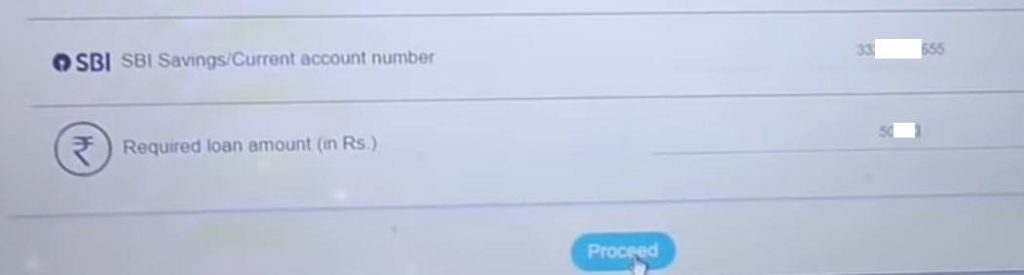

- After this enter your State Bank of India account number

- Next step will be to enter loan amount. As you have been told the maximum loan amount is fifty thousand, then you will not be able to put more than this amount.

- Then click on the proceed

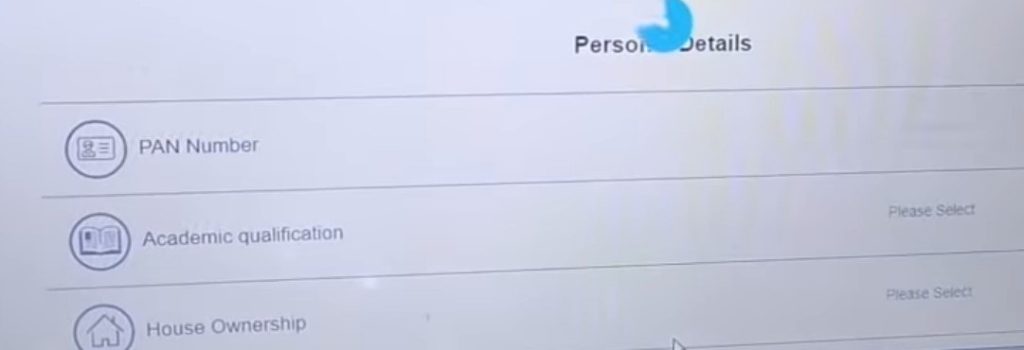

- In the next page, click on the details of personal details like PAN number, educational qualification, house ownership, monthly income, information of dependent family members, social category, minority community etc.

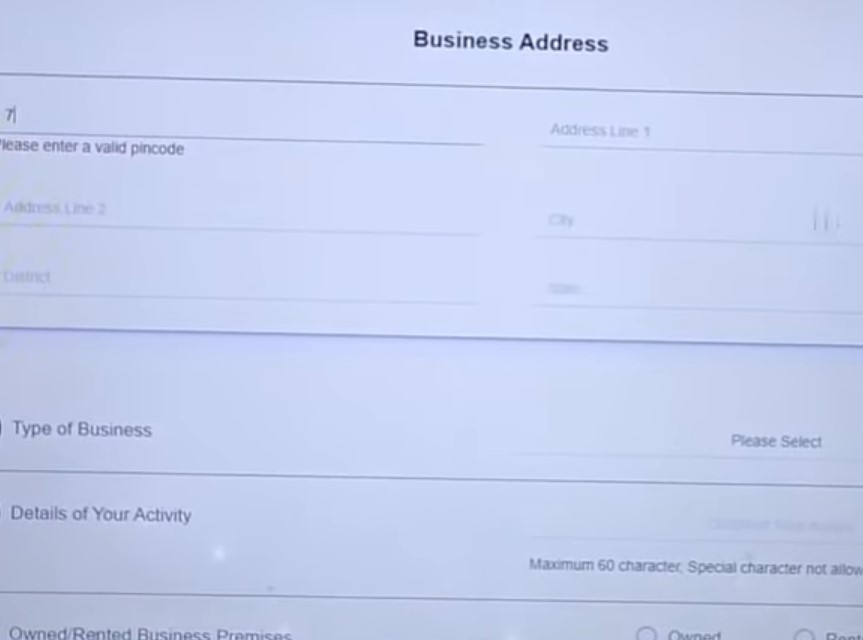

- Business information will be sought in the next page

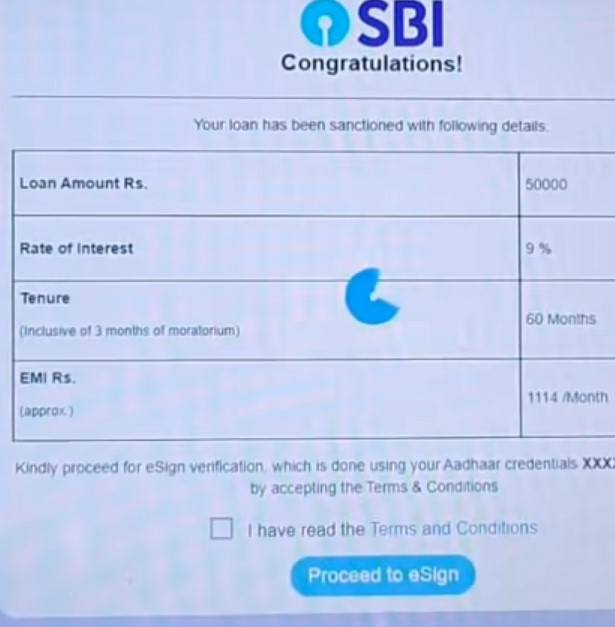

- After filling all these, you will be shown all the information filled in the next page. If all seems correct, check the term and condition box and click on “Proceed to this sign”.

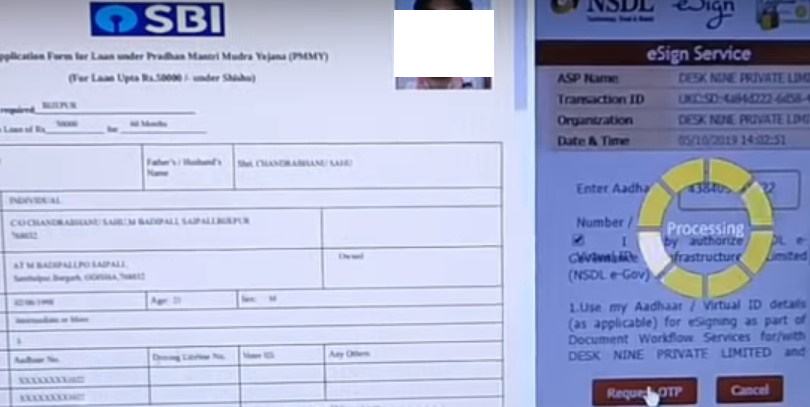

- Now the next page will be e-signed through Aadhaar verification. OTP will come on your phone, put OTP and sign it.

- After this is done correctly, you will see the confirmation in the next page, then click on the procedure. After this a new page will open in which you will be told that your application has been accepted. Be sure to print it out.

Important note: Friends! It is seen that the official website has not been opened for some time. Along with this, all the information and material of the e-currency scheme has been removed from the official website of the State Bank. It is incomprehensible why this has happened. We hope that after some time online applications will be taken again.

The process given above was only for the consumers of State Bank of India, besides the account holders of other banks can also apply for Mudra loan on the official website of Mudra Loan

- State Bank of India

- Bank of baroda

- Federal bank

- Vijaya Bank

- Bank of Maharashtra

- ICICI Bank

- Axis Bank

- Yes Bank

- Union Bank of India

- Punjab National Bank

- Dena Bank

- Andhra Bank

- IDBI Bank

Q1. What is SBI E-Mudra Loan?

E Mudra Loan (SBI E-Mudra) is a facility for customers of State Bank of India to take Mudra loan. Loans up to fifty thousand can be taken under this facility.

Q2. How to apply for E Mudra loan?

Applications for loans will be accepted online. Applications have also been taken for some time. I hope applications will be withdrawn soon.

Q3. Can an applicant from any other bank also avail benefits under this scheme?

No, the benefit of this scheme will be available only to the eligible persons of State Bank

Hope through this article, you will get all the information about SBI E Mudra Loan. Write down for any questions or suggestions