Hi friends hope you are doing well, we talk about today Form 16 What is it, Form 16A, Form 16B, What is Form 16, how to get form 16, form 16 eligibility salary, form 16 pdf

Form 16 is a file or certificates issued to salaried experts in India through their respective employers below segment 203 of the Income Tax Act of 1961. This shape is one of the maximum critical files for submitting Income Tax Return (ITR). This file or certificates confirms that TDS has been deducted or deposited with the government on behalf of the employee. If you furthermore may need to get whole facts approximately what’s Form 16, then in this newsletter we’re going to come up with whole facts.

If you figure in a organisation and your annual profits is greater than the minimal exemption restrict of profits tax 2,50,000 then you need to deduct TDS out of your revenue and fill profits tax and we want Form 16 best for filling profits tax. This shape is furnished to you through your organisation or enterprise. With the assist of this shape, you could get whole facts approximately TDS deducted out of your account. In this you may additionally get facts approximately the enterprise deducting TDS and in case you what’s Form 16? If you need to get whole facts approximately this, then live with us until the end.

What is Form 16 ?

You have to understand approximately profits tax that, while your revenue is greater than a minimal restrict, then you need to pay profits tax. This manner is performed through your organisation or enterprise. In this, the enterprise deducts tax out of your revenue and sends it to the authorities, which we name TDS. We upload the facts of TDS deduction and tax deposited with the authorities in Form 16.

Form 16 is a kind of certificates wherein the facts of TDS deducted out of your revenue is added. This is evidence that the TDS deducted out of your revenue has been well deposited to the authorities, subsequently it’s also referred to as Salary/TDS certificates.

Form 16 is split into elements wherein the primary is Form 16A and the second one is Form 16B.

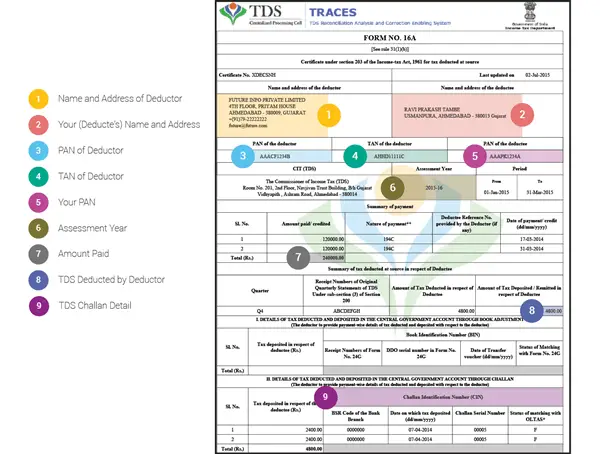

Form 16A

This element consists of whole facts approximately your TDS. This is your tax submitting certificates. It consists of whole facts of the enterprise deducting TDS inclusive of name, address, pin variety, ten variety etc. and it additionally consists of whole facts of the man or woman deducting TDS inclusive of name, address, pin variety etc. It consists of many greater facts associated with your revenue.

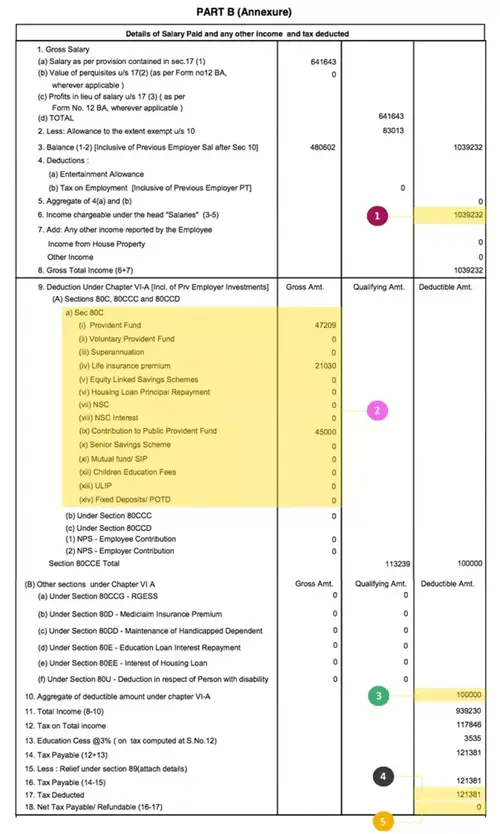

Form 16B

In this, your revenue is calculated and the element on which tax is deducted, in addition to all different exemptions are calculated. In this your transactions also are counted. The calculation of financial savings is likewise performed below segment 80C and plenty of different facts is calculated one after the different.

How to get Form 16

The need to download Form 16 is very less as this form will be received from you, the organization in which you are working or from the employer of that place. Which you can fill and submit and for some reason you do not receive Form 16A and 16B from both of them, then you can download it from the official website of Income Tax www.incometaxindia.gov.in. Here you will get Form 16 in word format and Form 16 download in PDF both. Apart from this, you will get all the forms related to Income Tax here.

Learn more article here:

- SBI Business Loan

- What is Cibil Score

- Best Retirement Mutual Funds

- What is Senior Citizen Health Insurance

- What is Endowment Plans

Conclusion

If you are an employee of a company and your salary is more than the minimum exemption limit of income tax of 2,50,000 then this information is definitely important for you. What is Form 16 to you in our post? And how to get Form 16? All the information about this would have been well received. If you liked this interesting information related to Form 16, then do not forget to share it and if you always want to get similar information then stay connected with us on Fastread, thank you!