The Income Tax Department has started the online application process to create an instant e-PAN card. It is a simple and hassle free process and online application requires only Aadhar Card 12 digit biometric number. Aadhaar number can be used as proof of identity (ID), address and date of birth (D.O.B.). Now people can easily apply online for instant e-PAN on the official website incometaxindiaefiling.gov.in

Real-time near instant e-PAN allocation (beta version) is available free for a limited period. Individuals (other than minors) with a valid Aadhaar number (with updated mobile number) can avail the e-PAN allocation facility. This facility is not applicable to undivided Hindu families, companies and trusts.

The facility of obtaining PAN number through Aadhaar Card is on first come first served basis. All persons who do not have PAN card (PAN number) can apply online and can also view the status.

Apply online for instant e-PAN card using Aadhaar card number

It is a paperless process and does not require any physical documents to be sent by the PAN applicant. All the details in the e-PAN application form must exactly match the Aadhaar card details as this is the only proof in this process. The complete procedure to fill online application form for instant e-PAN is given below: –

- Go to official website incometaxindiaefiling.gov.in

- On the homepage, click on the link “Instant e-PAN” under the ‘Quick Links’ section or click on this link directly

- Read all the instructions carefully and then click the “Apply Instant e-PAN” button. Read the next guideline and click on the “Next” button for Aadhaar e-KYC.

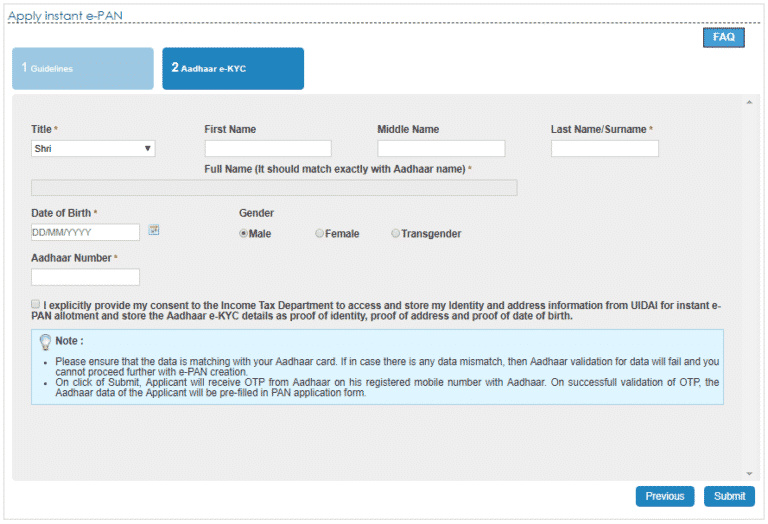

- The instant e-PAN Aadhaar e-KYC online application form will appear as follows: –

- Fill all the details and upload the color with signature (200 dpi resolution, JPEG format, maximum size 10 KB and dimensions – 2 * 4.5 cm).

After Aadhaar becomes e-KYC, then the process of applying for e-PAN will be started. After successful filing of the e-PAN application form, a 15-digit acknowledgment number will be generated and sent to the registered mobile number / e-mail ID in the application form.

Check status and download instant e-PAN

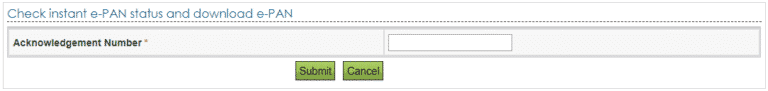

All the applicants can check the status of the application and can also download the instant e-PAN card using the acknowledgment number through the link given below: –

- The status and download page of the instant e-PAN application will appear as follows: –

Terms of filling the instant e-PAN online application form

Before filling the e-PAN application form, any person must fulfill the following conditions: –

- Applicants who already have PAN number, should not apply for e-PAN.

- E-PAN facility is applicable only to resident individuals (except minors and others covered under U / S of IT Act, 1961).

- This facility is also not applicable to HUFs, Firms, Trusts and Companies.

- The candidate must have a valid and active mobile number and must be registered with Aadhaar. Aadhaar OTP is required in this process for verification (no other documents are required). If not, click on this link – Verify email and mobile number on Aadhaar

- Aadhaar card details like name, gender, address, mobile number should be correct and updated as e-KYC will be done through Aadhaar database. If not, click on Aadhaar card details update

Benefits of instant e-pan card

Currently, applicants are required to fill the form and submit a document which is up to 15 days in order to obtain a PAN card. Now those who want to apply for e-PAN immediately, they have to enter basic details like name, address, Aadhaar details. Applicants have to verify their details by using a one-time password (OTP) on their registered mobile phone number.

Aadhaar already has details such as address, father’s name and date of birth, so no physical documents will need to be uploaded. However, applicants need to ensure that their Aadhaar details are correct in case of data mismatch as the application may get rejected.

On successful verification of the Aadhaar details using OTP, the applicant will be issued a digitally signed e-PAN with a QR code. This QR code will take demographic data along with the photo of the applicant. As a security measure, the information in the QR code will be encrypted to prevent forgery or digital photoshopping.

The Accelerated E-PAN initiative is part of greater digitization of income tax services. This facility will enable people to get PAN card through online mode without making unnecessary visits to the office. After a successful trial of more than 62,000 e-PANs in 8 days, the immediate e-PAN service will be launched nationwide in the next few weeks. This feature will help people with existing PANs get duplicates within a few minutes.

Quick Link

Go to Official Website Click Here