Friends, today we will read about What is CIBIL Score, CIBIL Score rating, how to check CIBIL Score, pass bazar CIBIL Score check, how to improve CIBIL Score immediately, How to check Credit Score

CIBIL Score is a 3-digit numeric quantity of your credit score history, score and report, which tiers from three hundred to 900. The nearer your rating is to 900, the higher your credit score score. It may be referred to as a whole description of the credit score profile of any person. Meaning, how someone has paid off his debt or how has been his mind-set in paying the mortgage, etc., on the idea of those things, the credit score rating is prepared. If you furthermore mght need to realize what’s CIBIL Score and the way to test CIBIL Score, then study the complete post.

CIBIL Score has emerge as a need in addition to an vital issue in state-of-the-art times. It could be very vital with a purpose to realize this information. CIBIL rating is likewise referred to as credit score rating. This is requested of you on the time of taking your mortgage. The significance of your credit score rating or CIBIL rating has multiplied plenty withinside the latest times. If your CIBIL rating is low, you could have problem getting a mortgage or credit score card or you could must pay a better hobby charge at the mortgage.

So let’s realize what’s CIBIL Score? How to test CIBIL Score and the way low CIBIL rating will have an effect on your mortgage.

What is CIBIL Score?

When you go to take a loan from the bank, then the bank assesses your ability or ability to repay the loan. If the bank is able to repay the loan to you, then the loan is given to you. Along with this, the bank also checks whether you have repaid your old loan on time or not, for this, the report it sees is called credit report or credit score.

The report of the last six months of the borrower is seen and his financial data is studied. After this, keeping in mind some factors, a score is determined for him, which if good, then the bank gives loan to that person easily. And if not, then getting a loan becomes a bit difficult.

Credit score in a way reflects your ability to repay the loan. Whenever you have taken any loan (home loan, personal loan, car loan, credit card loan etc.) in the past, whether you have repaid that loan on time or not! All this information is recorded in your credit score.

The bank cannot collect all this information on its own. That is why he takes this information from the credit information company. Companies that provide credit information are also called credit bureaus. There are many such companies in India, in which CIBIL is the main one.

CIBIL Score Meaning

CIBIL is the name of a company that holds your credit information data, CIBIL is India’s first credit information company.

Now if you also want to take a loan, then you will have to tell your credit score to the bank, earlier you had to pay an amount to check the CIBIL score, but now this service has been made absolutely free. Now you can check your credit score sitting at home.

CIBIL Full Form

The full name of CIBIL is ‘Credit Information Bureau of India Limited’ and also known as ‘Credit Information Bureau of India Limited’ in Hindi.

How to check CIBIL Score?

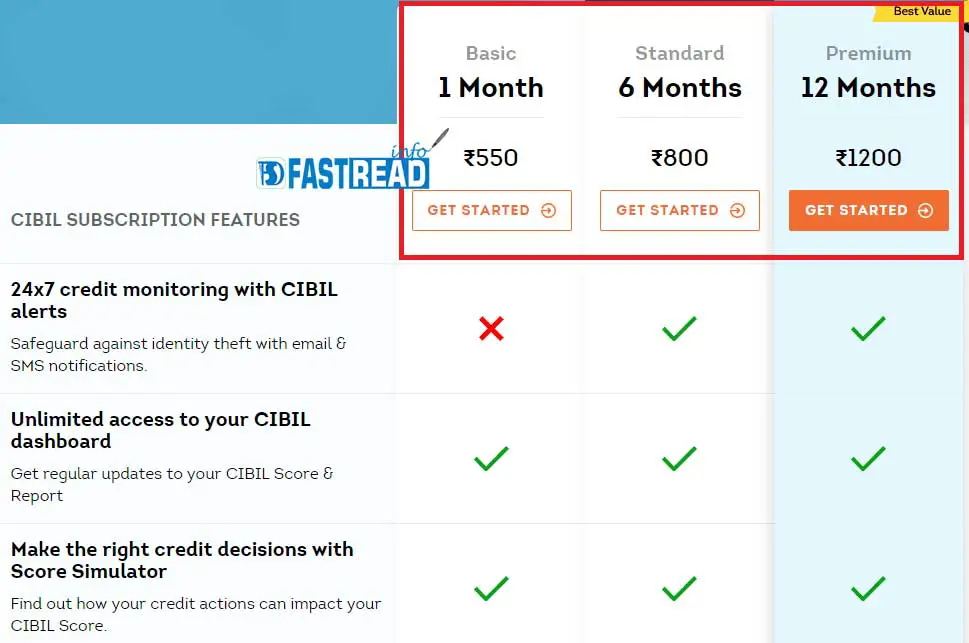

To check CIBIL score, you get this facility for free on CIBIL website. But you can also check your credit score or report by taking its subscription plan. You can check your current CIBIL report only once in a year without subscription. If you take its paid plan, then you also get additional features in it.

- To get CIBIL report for free, you do not have to work hard, all you have to do is visit the official website of CIBIL and follow some steps given below –

- To get the credit report, go to the CIBIL website ‘www.cibil.com’ and click on “Get Your CIBIL Score” given at the top right corner.

- Now you have to choose any one plan from three plans (Basic, Standard and Premium).

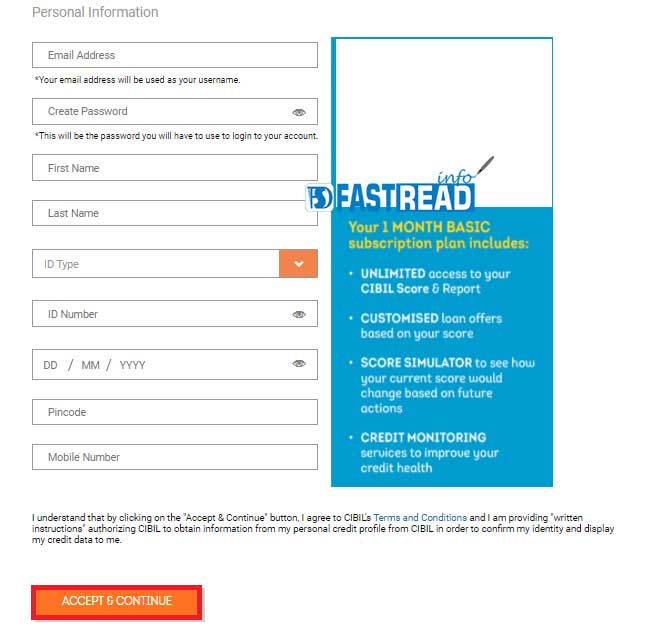

- After selecting the basic plan, you will have to fill some of your basic details, after that you can apply for your CIBIL Score Report by clicking on ‘Accept & Continue’.

- In the next step, you will get an OTP (One-Time Password) on the mobile number you have given to verify your identity, enter it and click on ‘Continue’.

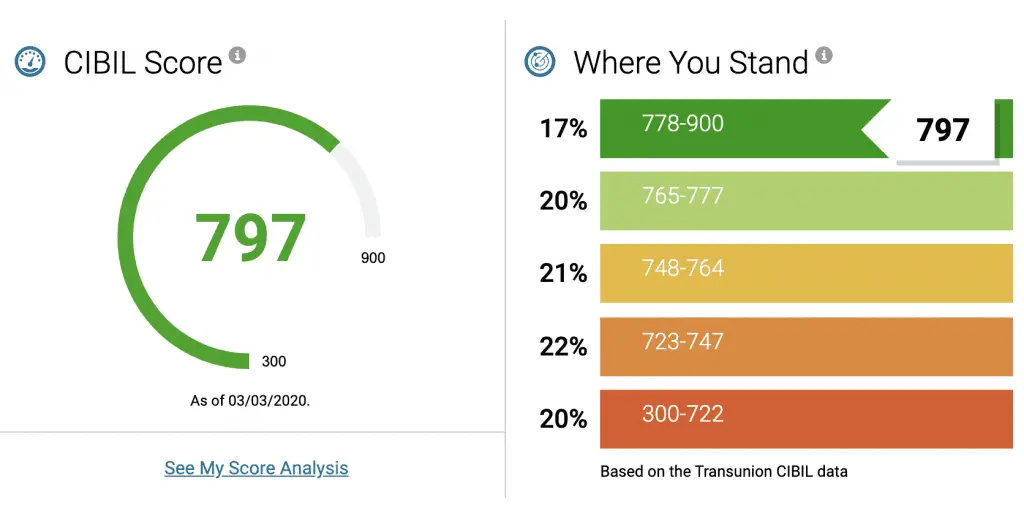

- Now you will see a message which means that you have successfully enrolled. Whose message is sent to you on email. Click on the ‘GO to Dashboard’ option to check your credit score report.

- Now you will be taken to the website of myscore.cibil.com, where you can check your CIBIL score and CIBIL report for free.

Conclusion

When you have successfully created your account on it, then you can check your CIBIL score anytime by ‘Log In’ on myscore.cibil.com. However, you will need to enter your email id and password to log in. Note, if you have opted for the free plan, then you can check your CIBIL score only once in a year. To check CIBIL score more than once in a year, you have to take a paid subscription plan.

Hope you have liked this post and you have understood everything very well, which we have tried to tell in very simple language. If you liked this post of ours, then share it with your friends also.