According to Pradhan Mantri Fasal Bima Yojana 2020 Details, all farmers in India will be provided insurance for their crops. If there is any loss and damage to Indian farmers in future with their crops, then in such a situation, under the PMFBY scheme, all those farmers will get financial assistance according to the losses incurred in their crops. Pradhan Mantri Fasal Bima Yojana 2020 is designed to encourage farmers and ensure their continuity in farming. The objective of this scheme is to empower the farmers and move India towards developed countries. This scheme will definitely promote self-confidence among the farmers of the country and encourage them to do good farming.

PMFBY Scheme 2020

This effective PMFBY Scheme 2020 has been launched by the Ministry of Agriculture and Farmers Welfare, Government of India. Pradhan Mantri Fasal Bima Yojana 2020 has been started for farmers to insure their crop and solve questions and concerns with the help of web portals and provide correct guidance. At the same time, this department also provides information about various projects to the farmers.

Risks Covered Under Pradhan Mantri Fasal Bima Yojana 2019

Under this project, if the crop of the farmer suffers any damage due to natural fire, storm, lightning, volcano, flood, drought, pest diseases etc., then he will be provided insurance in PMFBY Scheme 2020.

Key Features of PMFBY Scheme

- Disasters such as hail, water logging and land slides will be considered as local calamities.

- If there is waterlogging in the farmer’s farm, then the claim amount will be provided to them.

- The crop is in the field for 14 days after harvesting and if any of the above calamity comes, the farmer will be provided with claim money.

Detail Of Crops & Premium Under PMFBY Scheme

| Sr No. | Crop | Percentage of insurance payable by the farmer |

| 1 | Kharif | 2.0% |

| 2 | Rabi | 1.5% |

| 3Annual Commercial and Horticultural Crops | 5% |

PMFBY Scheme Calendar Of Activity

| Activity calendar | Kharif | Rabi |

| Loans sanctioned for loanee farmers on compulsory basis. | From april to july | October to December |

| Cut off date for receipt of proposals from farmers (lenders and non-lenders). | 31 July | 31 Dicember |

| Cut off date for obtaining yield data | Within a month of the last harvest | Within a month of the last harvest |

Revised Pradhan Mantri Fasal Bima Scheme 2020

| Kinds of MFBS | For 2016 | For 2019 |

| Premium amount payable by farmer | Rs. 900 | Rs. 600 |

| In the case of 100 percent loss, the amount received by the farmer | Rs. 15000 | Rs. 30000 |

Revised Operational Guidelines of PMFBY Scheme 2020

Amended operational guidelines for Pradhan Mantri Fasal Bima Yojana (PMFBY) which is being implemented from 1 October 2018. To get complete information about the Revised Operational Guidelines of PMFBY Scheme 2019, you can get complete information with the help of the below given source and we are confident that it will help you in your crop insurance.

Apply Online PMFBY Scheme

If agriculture is the main source of your income, then you should protect your crop under Pradhan Mantri Crop Insurance Scheme 2019 so that you can fully protect your crop from the damage caused by natural calamity. For this, you have to go to the PMFBY Scheme 2019 main website and register by providing some information. Complete information is being provided to you step by step. It is always our endeavor to provide you with complete, clear and correct information.

How to Apply Pradhan Mantri Fasal Bima Yojana

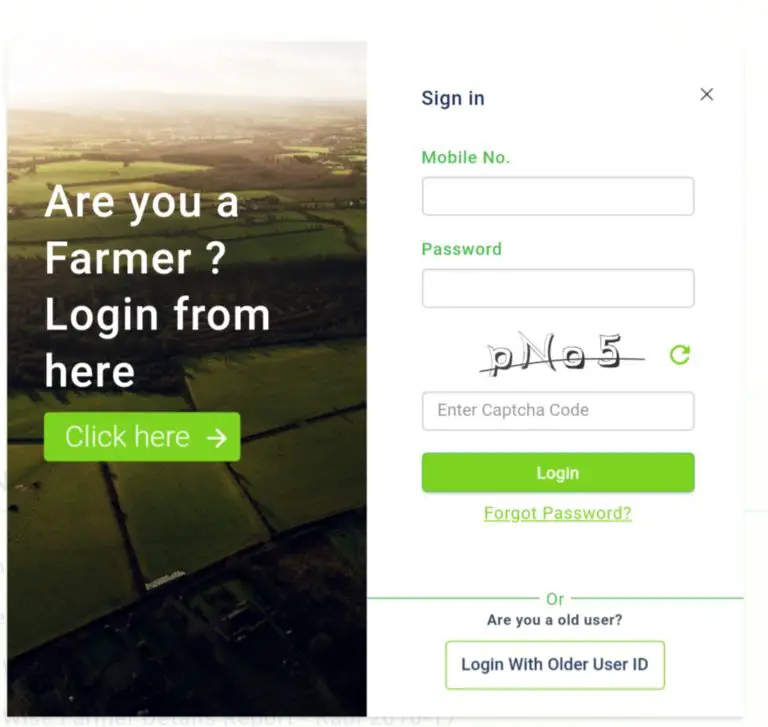

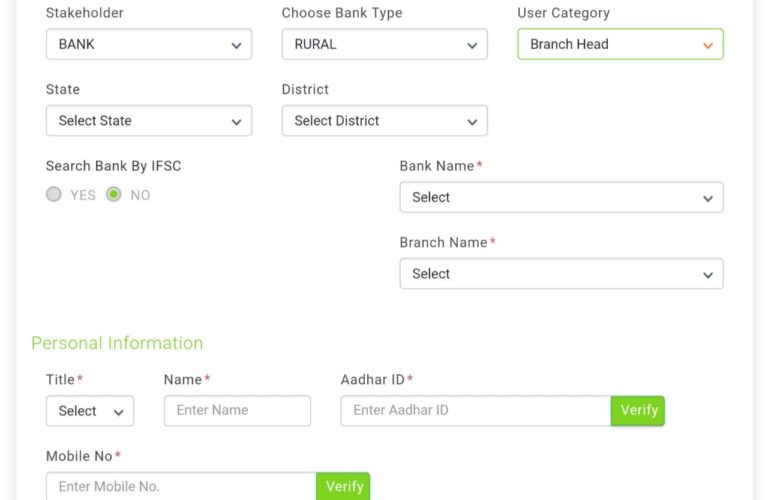

- First of all, go to the main website of Pradhan Mantri Fasal Bima Yojana 2019.

- After this, register yourself on the given portal.

- Under this, you will have to provide some information which is shown below.

- Now you press the Create button.

- After this you get more information like your bank name, type of insurance etc.

- After providing all these information, you will have to verify your mobile number.

- Thus you can easily make yourself. Apply Online PMFBY Scheme 2019 can be registered.

- After registration, you can easily add Pradhan Mantri Fasal Bima Yojana 2019 9 to your crop by providing your mobile number and password by going to Sign In.