Sukanya Samriddhi Yojana Calculator| Sukanya Samriddhi Yojana calculator| SSY Online| Sukanya Samriddhi Yojana Form|

Sukanya Samriddhi Yojana is an ambitious scheme of the NDA government led by Narendra Modi, to reinforce the idea of ”Save for every girl”. As a part of the “Beti Bachao Beti Padhao” campaign, Sukanya Samriddhi Account Scheme is a small savings scheme. The scheme can also be considered a part of the NDA government’s initiative to increase the household savings percentage, which has been reduced from 8% in 2008 to 8% in 2013 to only 30%. This scheme will also encourage parents to save the girl child. Children and spend on their education and marriage.

Salient Features of Sukanya Samriddhi Yojana

- The attractive interest rate in Sukanya Samriddhi Account is 8.4% (from 1 October 2019 to 31 December 2019) which is regulated by the Ministry of Finance from time to time (on quarterly basis).

- The account can be opened in the name of the girl child, till she attains the age of 10 years.

- Only one account can be opened in the name of a girl child.

- The account can be opened in post offices or notified branches of HDFC Bank, ICICI Bank, PNB Bank, SBI Bank or any other bank across the country.

- Birth certificate of the girl child, in whose name the account has been opened, should be produced and presented.

- Account can be opened with minimum amount. 250 / – and any amount thereafter can be deposited in multiples of Rs. 100 / -.

- From the date of account opening, deposits in an account can be made till the completion of 14 years.

- Minimum Rs. 250 / – has to be deposited in a financial year.

- Interest @ as notified from time to time by the Government, will be calculated on an annual basis and credited to the account.

- Maximum Rs. 1,50,000 / – can be deposited in a financial year.

- A withdrawal will be allowed upon the account holder attaining 18 years of age to meet the expenses of education / marriage at the rate of 50% of the balance on the credit of the preceding financial year.

- The account can be transferred to any post office / bank anywhere in India.

- The account will mature on completion of 21 years from the date of account opening.

Sukanya Samriddhi Yojana 2020 Intrest Rate

Sukanya Samriddhi Yojana 2021 8.6% percent interest rate will be provided which is higher than higher than old-time favourites such as PPF, FD and recurring deposits. Tax benefit under section 80 C of the Income Tax Act, 1961 will also be provided to the parent and legal guardians.

| Financial Year | Interest rate |

| From April 1, 2014 | 9.1% |

| From April 1, 2015 | 9.2% |

| From April 1, 2016 -June 30, 2016 | 8.6% |

| From July 1, 2016-September 30, 2016 | 8.6% |

| From October 1, 2016-December 31, 2016 | 8.5% |

| From January 1, 2018 – March 31, 2018 | 8.3% |

| From April 1, 2018 -June 30, 2018 | 8.1% |

| From July 1, 2018 -September 30, 2018 | 8.1% |

| From October 1, 2018 – December 31, 2018 | 8.5% |

| 1 January 2019 – 31 March 2019 | 8.5% |

सुकन्या समृद्धि योजना 2021

सुकन्या समृद्धि योजना 2021 के तहत आप अपनी बच्चियों के भविष्य को आसानी से सुरक्षित कर सकते है। कोई भी माता पिता एवं अभिवावक किसी भी बालिका का 10 वर्ष की आयु से पूर्ण होने से पहले सुकन्या समृद्धि योजना 2019 के अन्तर्गत किसी भी मान्यता प्राप्त बैक एवं पोस्ट आफिस में बैंक अकाउंट खोल सकता हैंा इसके बारे में आपको पूर्ण व सही जानकारी आपको नीचे दिये भागो में मिल जायेगी।

New rules of sukanya samriddhi yojana 2021

- After opening the account, it can be operated till the girl child attains the age of 21 years or till she gets married after 18 years.

- According to the new rule of Sukanya Samriddhi Yojana 2021, only the native residents of India can take advantage of this scheme, if such a girl child starts living in any other country except India before the completion of this Sukanya Samriddhi Yojana 2021, then in such a situation she You will be deprived of this scheme.

- According to the new rules of Sukanya Samriddhi Yojana 2021, parents and guardians will have to provide information if the residential situation changes within a month.

Eligibility criteria

- Only girl child can apply for this scheme

- The age of the girl child should not be more than 10 years

- Only the parent or legal guardian has the right to open a bank account

- Only one account is allowed for a girl child and maximum accounts are allowed in a family.

Benefits of the plan

- The benefit of this scheme can be availed by those girls whose age is less than 10 years.

- You can open this account in your bank or post office near your home.

- According to the scheme, the government will provide financial assistance to the girl child at the time of her marriage and help the girl child to get higher secondary education.

- Both the girl child and her family will get the benefit of this scheme.

- Under Sukanya Samriddhi Yojana, two girls from a family can also get benefits.

Required documents

- Aadhar Card

- ration card income certificate

- caste certificate

- residence certificate

- Photo (of the parents and the girl child)

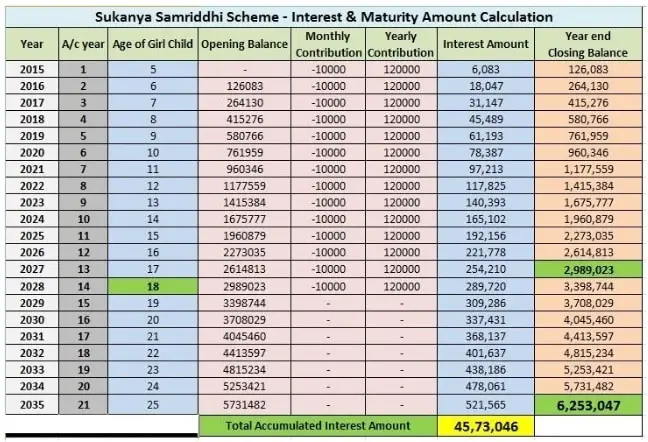

Sukanya Samriddhi Yojana Account Calculation

| Amount (Annual) (in ₹) |

Amount (14 yr) (in ₹) |

Maturity Amount (21 Years) (in ₹) |

| 1000 | 14000 | 46,821 |

| 2000 | 28000 | 93,643 |

| 5000 | 70000 | 2,34,107 |

| 10000 | 140000 | 4,68,215 |

| 20000 | 280000 | 9,36,429 |

| 50000 | 700000 | 23,41,073 |

| 100000 | 1400000 | 46,82,146 |

| 125000 | 1750000 | 58,52,683 |

| 150000 | 2100000 | 70,23,219 |

Sukanya Samriddhi 2021 Key Features

| Sno | Parameters | Details |

| 1 | Name | Sukanya Samriddhi Scheme |

| 2 | Account Type | Small Savings Scheme |

| 2 | Launch Date | 22nd January 2015 |

| 3 | Launched By | PM Narendra Modi |

| 4 | Target Audience | Girl Child |

| 5 | End Date | NA |

| 6 | Country | India |

| 7 | Current Interest Rate | 8.6% |

| 8 | Age Limit | 10 Years or Less |

| 9 | Deposit Limit | Minimum 250 , Maximum 1.5 Lakhs |

How to open Sukanya Samriddhi Account?

- A parent or legal guardian can open an account for a maximum of two girls. In case of twins or trio, exemption will be given on production of a certificate from authorized medical institutions.

- The account can be opened by the parents until the girl child attains the age of 10 years.

- The account can be opened only in the name of the girl child, parents will be able to deposit the amount only on behalf of the girl child.

- Accounts can be opened at post offices or designated bank branches across India.

Sukanya Samriddhi Yojana Account Online Apply

- SSY Account Opening Form (FORM I) – Sukanya Samriddhi Yojana Account Opening Form Online

- SY Application for Loan / Withdrawal (FORM 3) – Sukanya Samriddhi Yojana Application Loan / Withdrawal

- Application for Transfer of SSY Account (FORM 5) – Sukanya Samriddhi Account Transfer Form

- Application for premature closure of SSY Account (FORM 8) – Sukanya Samriddhi Account Premature Closure Form

- Application for Closure of SSY Account (FORM 9) – Sukanya Samriddhi Yojana Account Closure Form

Download pay-in slip, passbook and other SSY related forms – Sukanya Samriddhi Yojana Forms Download PDF

Sukanya Samriddhi Yojana Interest Rate Calculator Chart

Documents Required for Opening an Account?

- Birth certificate of the girl child.

- Address and photo identity proof (PAN Card, Voter ID, Aadhar Card) of the guardian.

Sukanya Samriddhi Yojana focuses mainly on girls and is the flagship scheme of the Indian Post Office and the Modi government.

Authorized banks for Opening Sukanya Account

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank Of Baroda (BOB)

- The Bank Of India (BOI)

- Bank Of Maharashtra (BOM)

- Canara Bank

- Central Bank Of India (CBI)

- Corporation Bank

- Dena Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank (IOB)

- Oriental Bank Of Commerce (OBC)

- Punjab & Sind Bank (PSB)

- Punjab National Bank (PNB)

- State Bank Of Bikaner & Jaipur (SBBJ)

- State Bank Of Hyderabad (SBH)

- The State Bank Of India (SBI)

- State Bank Of Mysore (SBM)

- State Bank Of Patiala (SBP)

- The State Bank Of Travancore (SBT)

- Syndicate Bank

- UCO Bank

- Union Bank Of India

- United Bank Of India

- Vijaya Bank

Important Links

Important FAQ?

What is Sukanya Samriddhi Yojana?

Sukanya Samriddhi yojana is a saving scheme. Under this scheme parents can open the bank account on the name of girl child for its marriage and education. Interest rate of this scheme is higher than the other saving schemes declared quarterly as other schemes.

Who can open an account under sukanya samriddhi yojana?

Parents or legal guardian of the girl child only can open this account.

What should be the age of the girl child while opening this account?

Age of the girl child is must not more than 10 years at the time of opening this account.

What would be the amount of initial investment while opening the account?

Initial amount of investment is Rs. 250 minimum.

When the withdrawal from this account is allowed?

One withdrawal is allowed when the age of the girl child is 18 years.

What would be the minimum and maximum annual deposit under this scheme?

Minimum Rs 250 and maximum Rs. 150000/- should be deposit per year in the account.

When the account can be closed or matured?

The account shall be matured when the girl child is getting married or completion of 21 year from the date of opening the account.

Where to open Sukanya Samriddhi account?

Parents can open Sukanya Samriddhi account in bank or post office and can transfer it easily from one bank to another or one post office to another.

What will be the current interest rate of the scheme?

Current interest rate is 8.5% per annum.