Bharat Bond ETF NFO will run from 14 to 17 July but you can also invest later as these are open ended schemes

New ETF

ETFs have low expense ratios. The expense ratio for Bharat Bond ETF is capped at 0.0005%. Other active debt funds are generally in the 0.1–0.5% range, even for low-cost direct plans.

According to Edelweiss AMC, the new fund offer (NFO) will run from 14 to 17 July but you can also invest in it later as these are open ended schemes. Bharat Bond ETFs launched in December 2019 continue to trade in the market and can be bought and sold at any time.

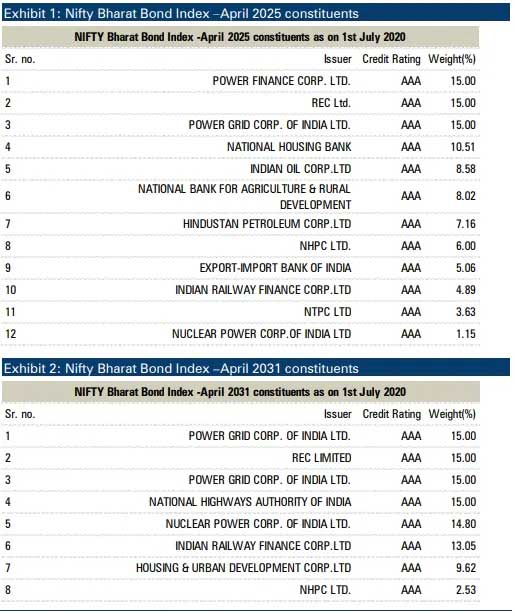

Two Bharat Bond ETFs have been mandated to track Bharat Bond Indices, which are exclusively PSUs. The indices for the new five-year and 11-year ETF track on July 1 yield 5.72% and 6.79% respectively.

Is India bond ETF a safe bet? Here’s what ICICI Direct says

The second tranche of the Bharat Bond Exchange-Traded Fund (ETF) in two fixed maturity investment options will be for subscription from July 14, 2020. The ETF will invest in a portfolio of AAA-rated bonds of state-run entities. . The new ETFs will mature in 2025 and 2031 will be referred to as Bharat Bond ETF April 2025 and Bharat Bond ETF 2031.

The government intends to raise up to Rs 14,000 crore through this ETF. In its first trance, it raised around Rs 12,400 crore.

In a recent report, brokerage house ICICI Direct stated that it is a safe long-term tax-efficient option. The Bharat Bond ETF provides a high degree of certainty of returns (if held-to-maturity) with high security of capital as it invests in government-owned AAA-rated public sector bonds.

ICICI suggests that with the current low-interest rate regime likely to continue, a smaller allocation may be considered by investors to look for safe and predictable returns. The five-year India bond ETF has an indicative yield of 5.6 percent for April 2025 and 6.7 percent for the 11-year April 2031 version.

Investment justification

- Stability and predictability: A bond like structure with fixed maturity provides predictable and stable returns at maturity

- High Security: Investment in public sector bonds

- Transparency: Daily disclosure of portfolio components and live NAVs

- Liquidity: Buy / Sell at any time or through AMC in exchange in specific basket sizes. Edelweiss has also come up with a Bharat Bond FoF. It enables retail investors to enter and exit like mutual funds.

- Tax-efficient: It is tax-efficient compared to traditional investment

- The way. Tax on 20% post indexation excluding surcharge

- Low cost: ETF’s expense ratio is only 0.0005 percent

How do they work

Bharat bond ETFs follow a roll-down maturity, meaning that the average maturity of their portfolio decreases as the ETF approaches its target dates. On a much broader level, if the 2025 ETF today has an average maturity of five years, it will be four years in 2021, three years in 2023 and so on. When the ETF reaches its target date, it terminates and pays customers.

This structure reduces interest rate risk – bond prices fall when interest rates rise.

To take a simple example, a traditional debt fund with an average maturity of three to five years will continue to buy bonds of this tenor when the old bond expires. As a result, if interest rates rise, investors will suffer no loss of one hit, regardless of how long they hold the fund. A roll-down fund, on the other hand, will see a gradual decline in its maturity and, therefore, investors who hold on to longer periods will see less risk of rate hikes. Interest Rate Risk Dogs Long-term mutual funds.

The product is considered safe because it invests in securities of top-rated government bonds.

The first installment was launched in December 2019. The initial issue size was Rs 7,000 crore, which was oversubscribed about 1.8 times.