In a strategic move, Axis Bank has decided to implement changes to its renowned Vistara Credit Cards, effective from January 3, 2024. These alterations impact the eligibility criteria for earning Club Vistara Points (CV Points), particularly in certain spending categories. Let’s delve into the details of these modifications and explore the implications for cardholders.

Changes to CV Points Eligibility

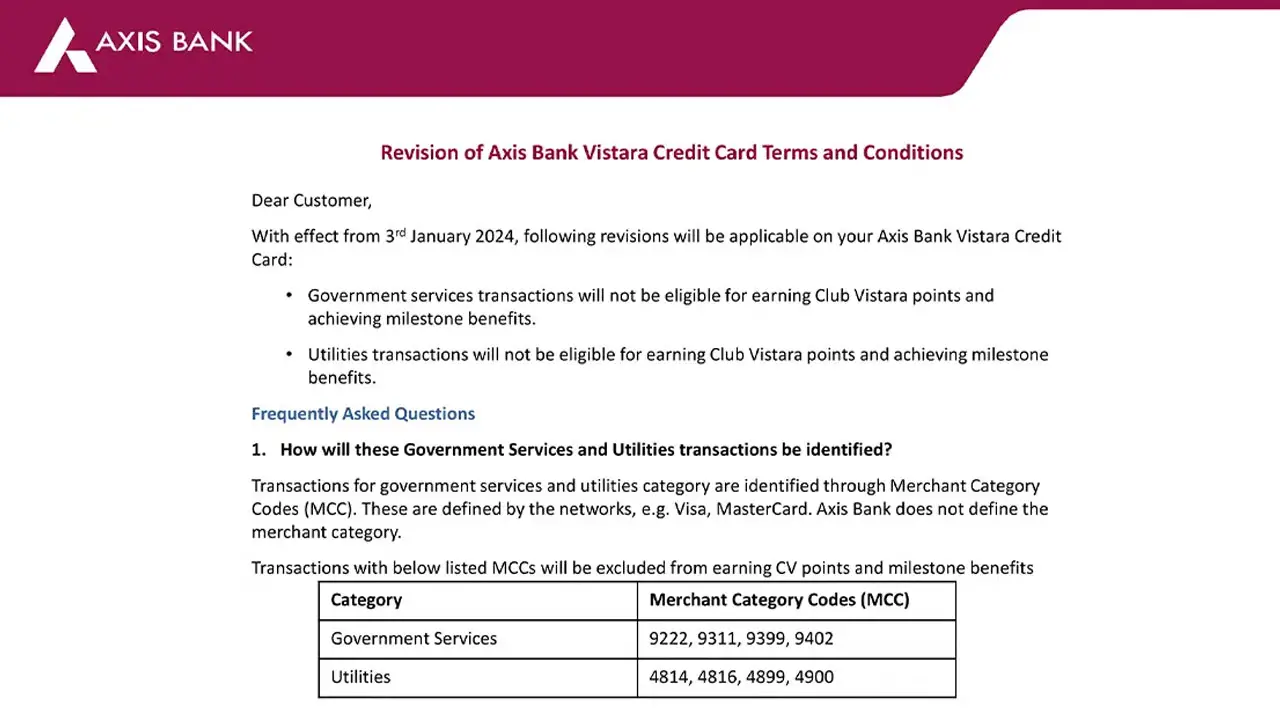

Starting from the mentioned date, Axis Bank Vistara Credit Cards will no longer accrue CV Points for transactions falling within specific categories. Furthermore, expenditures in these categories will no longer contribute to milestone benefits. The affected categories include:

Government Transactions

CV Points will not be earned on transactions categorized under government services. This encompasses Merchant Category Codes (MCC) 9222, 9311, 9399, and 9402.

Utilities

Similarly, spends related to utilities will not qualify for CV Points. This includes MCCs 4814, 4816, 4899, and 4900.

Insight into MCC Categories

To gain a clearer understanding, let’s spotlight the MCC categories that will no longer be eligible for CV Points:

- Government Services:

- MCCs: 9222, 9311, 9399, 9402

- Utilities:

- MCCs: 4814, 4816, 4899, 4900

Overview of Axis Bank Vistara Credit Cards

For those unfamiliar with the Axis Bank Vistara Credit Card series, here’s a brief summary:

Vistara Credit Card

- Joining/Renewal Fee: Rs. 1,500 + GST

- 2 CV Points Per Rs. 200 Spent on Eligible Categories

- Welcome Benefit: Economy Class Ticket & Club Vistara Base Membership

Vistara Signature Credit Card

- Joining/Renewal Fee: Rs. 3,000 + GST

- 4 CV Points Per Rs. 200 Spent on Eligible Categories

- Welcome Benefit: Premium Economy Class Ticket & Club Vistara Silver Membership

- 2 Complimentary Domestic Lounge Access Each Quarter

Vistara Infinite Credit Card

- Joining/Renewal Fee: Rs. 10,000 + GST

- 6 CV Points Per Rs. 200 Spent on Eligible Categories

- Welcome Benefit: Business Class Ticket & Club Vistara Gold Membership

- 2 Complimentary Domestic Lounge Access Each Quarter

Evolving Credit Card Landscape in India

This modification aligns with the broader trend of credit card devaluation in the Indian market. Notably, other major players, such as the Magnus Card and HDFC Bank, have also adjusted their offerings. Lounge access, a staple perk, has been removed from several cards. This indicates a significant transformation in the credit card landscape, with established banks revising their benefits.

Despite these industry shifts, the Vistara Credit Card series remains a compelling option. The series comprises three cards with distinct joining fees and benefits, catering to a diverse range of users. The Vistara Signature and Vistara Infinite, with higher joining fees, offer enhanced benefits, making them suitable for those seeking a more rewarding credit card experience. On the other hand, the Vistara Credit Card provides basic features at a more affordable joining cost.

Share Your Thoughts

What are your thoughts on Axis Bank’s revised rewards program for Vistara Credit Cards? Do you anticipate any impact on new applicants? Share your insights in the comments below. As the credit card landscape evolves, staying informed is key to making the most of your financial choices.