Revised Cashback Rates, Eligibility Conditions, and More: Axis Bank’s Updates to Flipkart Credit Card

The Axis Bank Flipkart credit card has emerged as a leading co-branded cashback card in India, catering especially to frequent shoppers on Flipkart and Myntra. Formerly, this card offered an impressive 5% cashback on all purchases made on Flipkart and Myntra, along with a generous 4% cashback on partner brands such as Swiggy, Uber, PVR, and more.

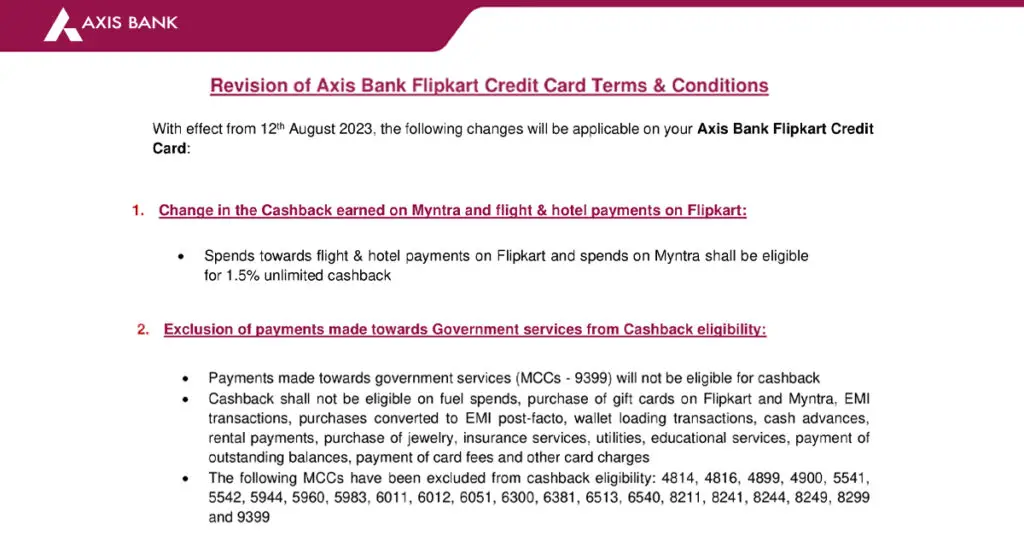

However, Axis Bank has recently announced significant revisions to the Flipkart credit card, affecting the cashback rates and introducing several alterations to the terms and conditions.

Let’s delve into the changes that will come into effect from the 12th of August 2023:

1. Cashback Updates for Myntra and Hotel/Flight Payments on Flipkart

Going forward, all transactions made on Myntra, as well as flight and hotel payments on Flipkart, will be eligible for an enticing 1.5% unlimited cashback.

2. Exclusion of Government Services Payments from Cashback Eligibility

Regrettably, any expenses related to government services will no longer qualify for cashback rewards.

3. Ineligible Transactions for Cashback

The following transactions are not eligible for cashback benefits:

- Purchases of Myntra and Flipkart gift cards

- Fuel expenses

- Purchases converted to EMI at a later date

- EMI transactions

- Wallet reloads

- Cash withdrawals

- Jewelry purchases

- Rent payments

- Utility payments

- Insurance services

- Educational services

- Payment of card fees and other charges

4. Updated Eligibility Criteria for Annual Fee Waiver

Cardholders can now have their annual fee waived if their total annual spending exceeds Rs. 3.5 Lakhs. However, please note that wallet reloads and rental payments will not be considered in the calculation for the annual fee waiver. Additionally, the waiver clause does not apply to cardholders who obtained the credit card on a lifetime free basis.

Undoubtedly, these modifications will not be welcomed by existing Axis Bank Flipkart cardholders. Share your thoughts on the updated terms and conditions in the comments section below.

The Impact of Axis Bank’s Revised Terms and Conditions on the Flipkart Axis Credit Card

Axis Bank and Flipkart have enjoyed a successful partnership with their co-branded credit card, offering attractive cashback rates and benefits to avid shoppers. However, the recent announcement by Axis Bank regarding revisions to the Flipkart Axis credit card’s terms and conditions has left many cardholders curious about the implications.

One of the most significant changes is the reduction in the cashback rate. Previously, cardholders enjoyed a lucrative 5% cashback on their purchases made on Flipkart and Myntra. This cashback rate was particularly appealing to loyal customers who frequently indulged in online shopping on these platforms. However, with the revised terms, the cashback rate has been brought down to 1.5%. This reduction undoubtedly comes as disappointing news for many cardholders who had grown accustomed to the higher cashback rate.

Additionally, the changes extend beyond cashback rates. Axis Bank has outlined specific eligibility criteria and restrictions for certain transactions. Transactions made on Myntra, flight bookings, and hotel payments on Flipkart will now earn an unlimited 1.5% cashback. However, it’s important to note that government service payments will no longer qualify for cashback rewards. This modification can be a significant blow to those who frequently use their credit card for such payments.

Furthermore, there are several transaction types that will no longer be eligible for cashback benefits. Purchases of gift cards from Myntra and Flipkart, fuel expenses, transactions converted to EMI at a later stage, EMI transactions themselves, wallet reloads, cash withdrawals, jewelry purchases, rent payments, utility payments, insurance services, educational services, payment of card fees, and other charges will not earn cashback.

In terms of the annual fee waiver, Axis Bank has introduced updated eligibility conditions. Cardholders can now have their annual fee waived if they spend Rs. 3.5 Lakhs or more within a year. However, it’s important to note that wallet reloads and rental payments will not be considered for the calculation of the annual fee waiver. Moreover, this waiver clause will not apply to cardholders who acquired the credit card on a lifetime free basis.

These changes to the terms and conditions of the Flipkart Axis credit card are significant and have left many cardholders feeling disappointed. The card, once celebrated for its exceptional cashback rates and benefits, will undergo a transformation that may not be received favorably by its loyal customer base.

It remains to be seen how these changes will impact the popularity of the Flipkart Axis credit card and the overall customer sentiment towards it. As the revised terms and conditions take effect from the 12th of August 2023, cardholders and avid shoppers are left contemplating their future choices and evaluating whether the card still aligns with their financial needs and preferences.

What are your thoughts on the updated terms and conditions? Share your perspective in the comments section below.