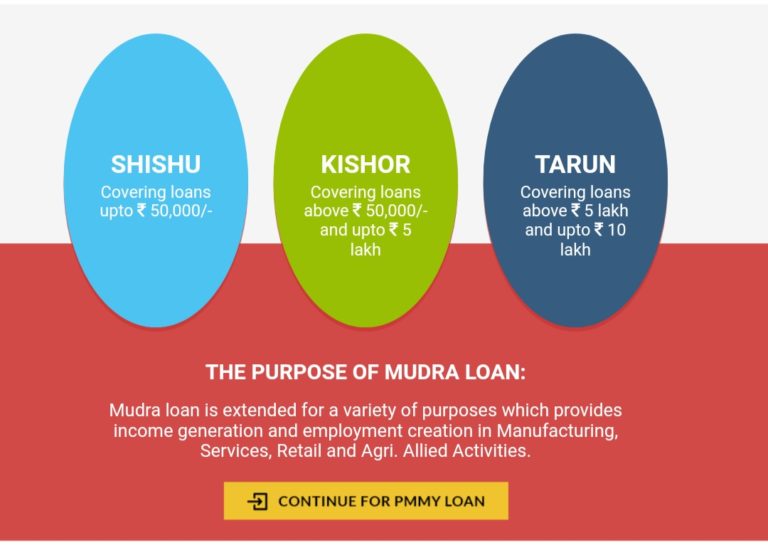

Pradhan Mantri Mudra Loan Yojana 2023 was inaugurated on 8 April 2015 by the Honorable Prime Minister, under this loan up to 10 lakh is provided to non-agricultural small and micro industries Pradhan Mantri Mudra Loan Yojana 2023 is classified into three categories. Shishu, Kishore and Tarun and these loans are provided by Commercial Bank, RRB, Small Finance Bank, Cooperative Bank, MFI and NBFC. With the help of PM Mudra Loan Scheme 2024, the Government of India wants to empower the small and micro enterprises of the country. The main objective of this scheme is to provide speed to development to the country. To get all the information related to Modi Mudra Loan, please study the given article thoroughly and avail the benefits of the scheme.

PM Mudra Loan Scheme 2024

Mudra Loan Scheme provides loans to micro and micro industries for income generation. Under Pradhan Mantri Mudra Yojana, you can take loans for any type of your business and further your business. There is no fixed interest rate under the Pradhan Mantri Mudra Yojana 2023. There are different types of interest rates for different types of loans, mainly this interest rate is 12%.

Prime Minister’s Mudra Loan Scheme Category 2023

- Shishu Loan provides loans up to Rs 50,000.

- Kishore loans offer loans ranging from 50,000 to 5 lakh rupees.

- Loans ranging from 5 lakh to 10 lakh are given under Tarun loan.

Salient Features of Mudra Loan Scheme 2024

- Under Mudra Yojana 2023, the debtor will not be required to provide any type of security cover while taking a loan.

- The loan interest rate available under this scheme is lower than the interest rate of the other bank.

- There will be no need to pay any additional fees under the Pradhan Mantri Mudra Loan Yojana 2023.

Banks under Pradhan Mantri Mudra Loan Scheme 2024

The following banks and institutions come under Pradhan Mantri Mudra Yojana 2023 which is as follows.

- 27 public banks

- 17 private banks

- 31 Regional Rural Banks

- 4 Cooperative Banks

- 36 Microfinance Institute

- 25 non-financial institutions

Eligibility Criteria for PMMY Scheme 2024

- The borrower should be an Indian citizen

- The borrower must be at least 18 years old

Documents for Pradhan Mantri Mudra Loan Scheme 2024

- Aadhar Card

- Pan Card

- Postal address

- Business address and proof of establishment

- Applicant should not be a defaulter from any bank

- Balance Sheet for last three years

- Income tax return and sales tax return

- Rent agreement

Apply online PMMY scheme 2023

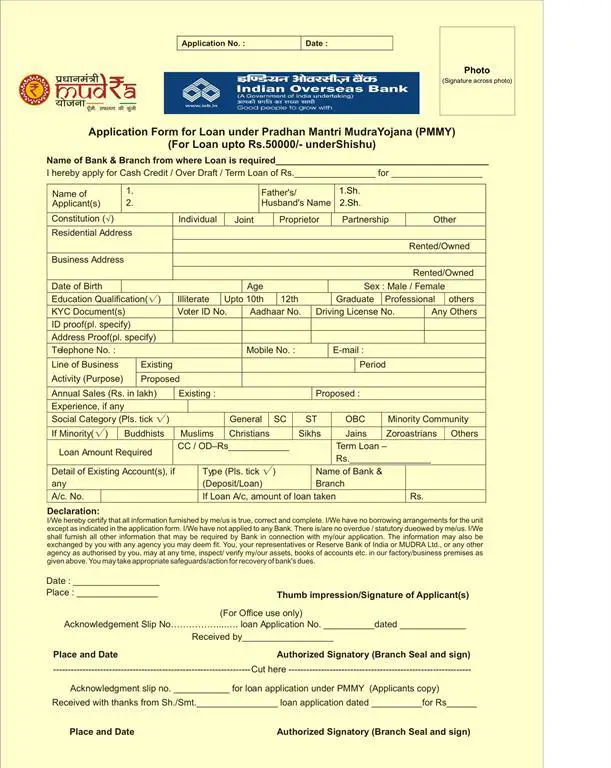

Under PMMY scheme 2023, you can avail loans from any government or private bank, Grameen Bank and other above mentioned banks. You can apply for the loan online by applying to the Bank Branch, Pradhan Mantri Mudra Loan Scheme 2024. After checking the documents, the loan will be provided to you by the bank.

How to apply online Mudra Loan Scheme 2024

- First of all put all your required documents as per the list given above.

- After this, you have to get a loan from a bank or institution, where you submit the collected documents.

- For Mudra loan, fill the application form received from the bank and fill the amount

- Finally, all your documents will be verified and the loan will be made available by the bank within 1 month.

Important Links

SBI eMudra loan Apply, Interest Rate, Eligibility