India Post mobile banking app available for download on Google Play Store, PO account holders can make PPF and Post Office deposits online, how to apply features, benefits, details to apply and activate the application on Android smartphone

The postal department has launched a new India Post mobile banking Android app for smartphone users. Now all post office account holders can deposit public provident fund (PPF) and post office through online. PO account holders can also transfer funds from savings account to their own linked PPF accounts online. People can download the latest version of India Post Mobile Banking App from Google Playstore.

This new India Post mobile banking app download will enable PO account holders to make transactions including deposits in PPF accounts and post office schemes. People will not have to travel or be physically present in post offices for this purpose.

To conduct transactions through the Postal Department’s new app, customers must have a Post Office Savings Account in a CBS or Core Banking Solution-enabled post office.

India post mobile banking app download

A post office customer must have a valid login and transaction credential of Internet banking. If internet banking is not enabled, then mobile banking should be enabled after net banking. People can now download India Post Mobile Banking App from Google Play Store or directly through the link given below: –

Click Here to Download India Post Mobile Banking App

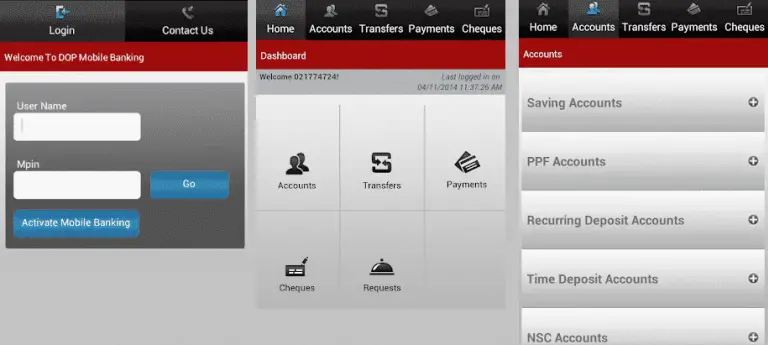

India Post mobile banking app will appear as follows:

How to activate India Post mobile banking app

People can now download India Post mobile banking application from Google Play Store. It is advised that PO account holders do not download this mobile app from unlicensed / unsecured website. The procedure to activate India Post Mobile Banking App is given below: –

- Open the India Post mobile app and click on the button “Activate Mobile Banking“.

- Then PO account holders have to file a security certificate which is provided with the postal department.

- There is no message fee for OTP (One Time Password). The Department of Posts will deliver the activation OTP to your registered mobile device. Then enter OTP on the screen asking you to enter OTP and proceed.

- After successful verification, PO account holders will be asked to enter a 4 digit MPIN. Please enter this 4 digit MPIN of your choice and you will be activated for the mobile banking application.

- To login to the mobile banking application, please enter your user ID and new MPIN

Other details to apply for India Post Mobile Banking

Any post office account holder will have to apply for mobile banking by filling the mobile / internet banking request form. If KY account holders have opened savings account after migration to CBS with proper KYC documents, there is no need to submit KYC documents.

If the PO account holder has opened a savings account before transferring the post office to CBS, new KYC documents will have to be submitted along with the service request.

India Post Mobile Banking App Features & Benefits

The list of benefits and features of India Post Mobile Banking App is as follows: –

- Get mini statement of savings, PPF accounts.

- Check the account balance of savings, RD, PPF and other accounts.

- You can transfer funds to other users in a post office saving account.

- You can also transfer funds from savings accounts to your own linked PPF accounts.

- Service requests can also be raised to open RD account and stop checks.

Safety advice

For security reasons, the application cannot be run from a rooted device. The Department of Posts never asks you to provide your MPIN, Transaction Password, User ID and OTP (One Time Password). All PO bank account holders are advised to be aware of such phishing by committing fraud.

Post office help desk

If the post office account holder is facing any difficulty or has any query, please contact our customer care number – 18004252440.

we request