Unveiling the Luxury: OneCard’s LTF Metal Credit Card – Review

In the realm of credit cards, metal is synonymous with luxury and premium features. On the other end, we have the simplicity of plastic entry-level cashback credit cards. What if these two worlds could coalesce seamlessly? Enter OneCard, where a sleek app and straightforward rewards converge to create a standout experience. Dive into this comprehensive OneCard review to determine if this Lifetime Free Metal credit card is the right fit for you.

The Unique Partnership: OneCard and Banking Partners

OneCard doesn’t possess the authority to issue credit cards independently. Instead, it collaborates with various commercial banks, essentially functioning as a co-branded credit card. Presently, OneCard has partnerships with:

- LTF IndusInd Bank Credit Cards

- Federal Bank

- SBM Bank

- South Indian Bank

- BoB Financial

Fee Structure: Breaking Down the Costs

Being a lifetime free card, OneCard eliminates joining and annual fees. However, certain charges, such as card replacement fees, are relatively higher. A quick overview of the fees includes:

- Joining Fee: Zero – LTF

- Annual Fee: Zero – LTF

- Forex Markup: 1% + GST (~1.18%)

- Card Replacement Fee: Rs 3000

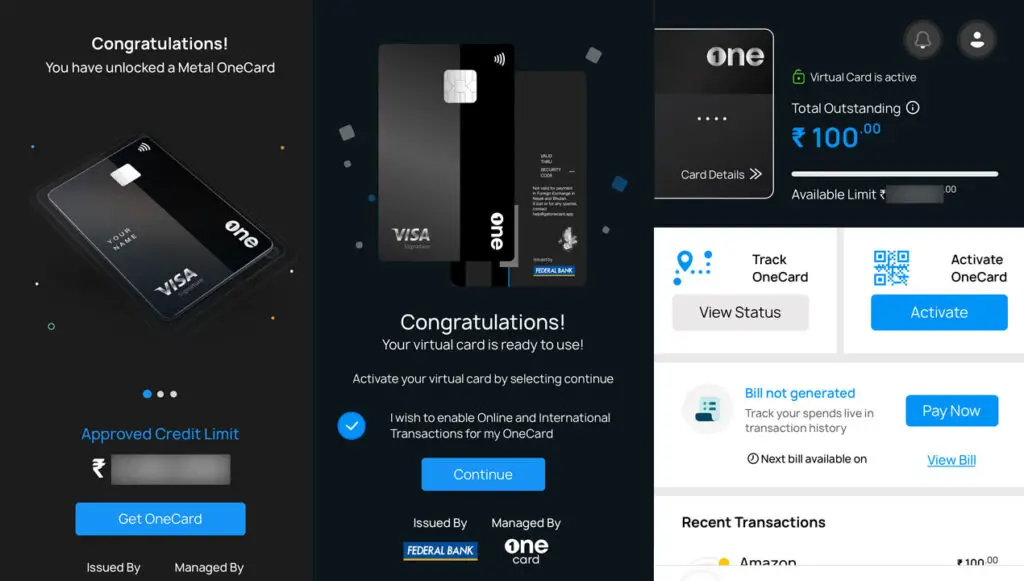

Streamlined Sign-Up: A FinTech Marvel

Similar to other FinTech platforms, OneCard boasts a simple and rapid sign-up process. The application, completed through the OneCard app, including KYC verification, takes less than two minutes.

For those seeking an invitation to apply, using the OneScore app is the key. Upon qualification, the virtual card is generated instantly post-KYC, available for online use, and the physical metal card arrives within 3-5 working days.

Rewarding Expenditures: Unveiling OneCard’s Rewards Program

Retail Spends

- Rewards: 1 RP/Rs 50

- Return: 0.2%

Top 2 Category Spends

- Rewards: 5 RP/Rs 50

- Return: 1%

Fuel and Wallet Spends

- No Rewards

- Zero Return

Earning rewards is swift, with points reflecting instantly in the app after each transaction. To qualify for 5X Rewards in the top two categories, a minimum expenditure in three categories (by MCC) is required. While the base reward rate is modest, OneCard stands out with enticing merchant offers throughout the year.

Seamless Rewards Redemption

OneCard distinguishes itself by not imposing any redemption fees and ensuring that reward points never expire. These points can be promptly redeemed through the OneCard app for statement credit or to offset a purchase. Each reward point holds a value of 10 paise, translating to Rs 50 statement credit for 500 reward points.

Transaction-wise reward point tracking, including bonus rewards, is conveniently accessible through the app.

The Power of OneCard’s App

The OneCard app serves as a sophisticated tool for card management, offering features like transaction controls and transaction history. The user experience is seamless, making it an ideal companion for a metal credit card.

Pros and Cons: Weighing the Advantages and Drawbacks

Pros:

- Quick and easy app-based sign-up

- Effortless card management via the sleek app

- Lifetime Free Metal credit card

- Low Forex Markup at 1%+GST

- Attractive Merchant Offers

Cons:

- Modest standard reward rate

- Absence of additional benefits on spends like airport lounge access

Final Verdict: Is OneCard Worth the Hype?

Despite its lower reward rate, OneCard’s allure persists, especially for those desiring a metal credit card experience. While the reward rate may not be stellar, the array of enticing merchant offers on platforms like Amazon and Flipkart, coupled with targeted spend offers, make it a compelling choice.

In an ideal scenario, a higher standard reward rate, perhaps at least 1%, would elevate OneCard’s standing, considering the competition. The 1% forex markup fee stands out as a positive feature, particularly beneficial for those without alternative cards offering better value.