Kotak Mahindra Bank and Myntra, the popular fashion e-commerce company in India, have partnered to introduce the Kotak Myntra Credit Card. This collaboration aims to appeal to the younger generation and fashion enthusiasts, offering them enticing benefits and rewards.

Myntra is renowned for its extensive collection of clothing, accessories, and renowned brands from India and around the world. With the Kotak Myntra Credit Card, users have the opportunity to earn instant cashback and rewards on their purchases. While there is a joining fee of Rs. 500, the card is currently being offered free of cost for a limited introductory period.

Let’s delve into the features, benefits, and other pertinent information regarding the Kotak Myntra Credit Card.

Kotak Myntra Credit Card Fees & Charges

The joining fee for Kotak Myntra credit card is Rs 500, but now for a limited time the joining fee has been reduced to Rs 0.

Also, an amount of Rs 500 has been fixed as the annual fee for Kotak Myntra credit card. If you spend more than 2 lakh rupees in a year through your Kotak credit card, then you will not have to pay its annual fee.

Kotak Myntra Credit Card Features and Benefits:

Welcome Benefit: Upon completing the first transaction with the card, users receive a welcome benefit in the form of a Myntra voucher worth Rs. 500.

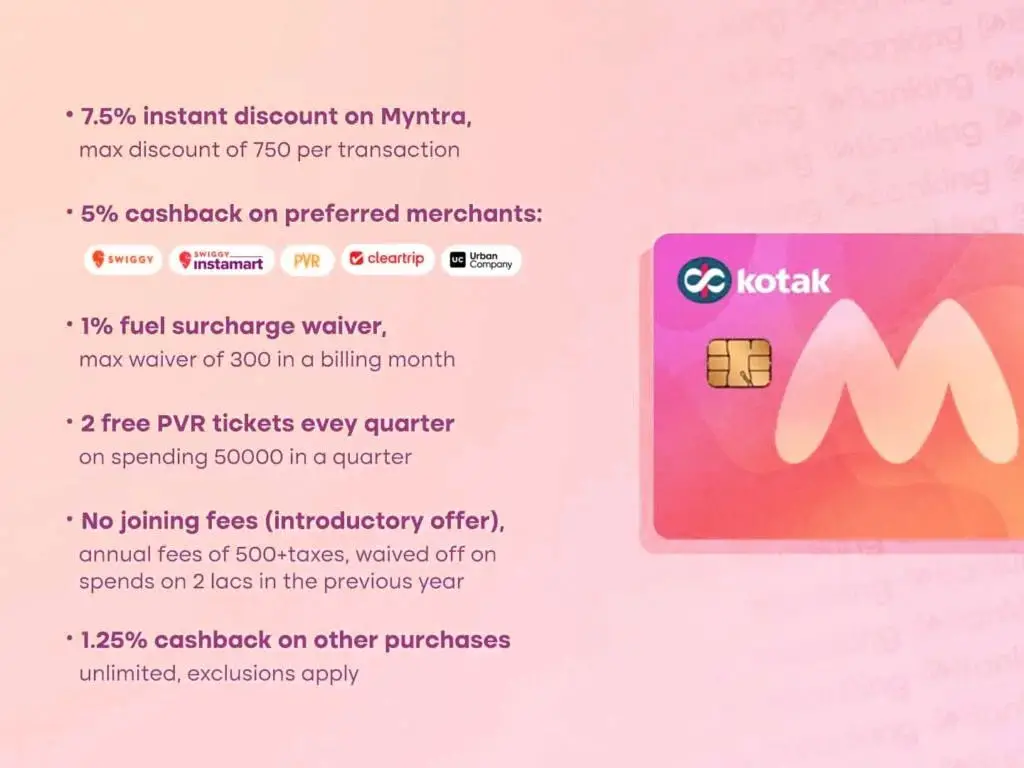

Unlimited Discount on Myntra Spends: Enjoy a 7.5% instant discount on all purchases made on Myntra. There is no limit to the total discount you can avail, although each transaction is capped at Rs. 750.

Cashback Benefits: Earn 5% cashback on spends at preferred partner brands such as Swiggy, Swiggy Instamart, Cleartrip, Urban Company, and PVR. The monthly cashback is limited to Rs. 1000. Additionally, receive 1.25% unlimited cashback on all other purchases, excluding rent, recharges, fuel, and EMI transactions.

Travel Benefit: Access complimentary domestic lounges with the Kotak Myntra Credit Card.

Milestone Benefit: Spend Rs. 50,000 or more per quarter and receive two PVR tickets valued at Rs. 250 each.

Renewal Fee Waiver: Spend Rs. 2 lakhs or more in the card anniversary year to have the Rs. 500 renewal fee waived.

Fuel Surcharge Waiver: Enjoy a 1% fuel surcharge waiver, up to Rs. 300 per month, at fuel stations across India. This translates to a maximum annual benefit of Rs. 3600.

Limited-Time Zero Joining Fee: While the card typically has a joining fee of Rs. 500, it is currently available with no joining fee for a limited time.

Kotak Myntra credit card eligibility criteria

To avail the Kotak Myntra credit card, you need to fulfill certain criteria set by the bank. Which is like this –

It is mandatory for the applicant to be between the age of 21 years to 60 years for Kotak Myntra credit card.

The applicant must be an Indian resident. Along with this, all certified valid documents by the Government of India should be available with the applicant.

Note – These norms are only indicative. Kotak Bank reserves the right to approve or decline applications for Myntra credit card.

Read this also – Kotak Mahindra Credit Cards

Conclusion:

Kotak Mahindra Bank boasts a satisfied customer base for its credit cards throughout India. The co-branded Kotak Myntra Credit Card is set to attract numerous young individuals and millennials. With a vast selection of clothing and apparel on Myntra, cardholders can enjoy a 7.5% instant discount on all their Myntra purchases.

In addition to the Myntra discount, the card offers 5% cashback on partner brands like Swiggy, and a generous 1.25% unlimited cashback on all other transactions, with a few exceptions. While the joining fee is nominal at Rs. 500, the current offer of a fee waiver makes it an even more appealing choice. Furthermore, by spending Rs. 2 lakhs or more annually, cardholders can have their renewal fee waived.

Feel free to share your thoughts on this new co-branded credit card by Myntra and Kotak Mahindra Bank in the comments section, and let us know if you plan on obtaining one for yourself.